Setting the Vision for a Product

Financial inclusion is more than a buzzword. It is a mission that impacts billions. When Paytm was founded in 2010, its product vision was more than just digital payments. It was financial empowerment for all.

Learnings: A clear product vision can steer a company towards solving more considerable, impactful problems.

The Problem: Identifying Market Needs | Product Market Research

According to the World Bank data, only 35% of adults in India had bank accounts in 2011. Cash dominated, leaving the unbanked in financial isolation.

Learnings: Understanding your customer’s pain points is the first step in any product’s journey.

The Solution: Product Pivot and Scaling

Paytm pivoted from just mobile recharge to becoming a financial ecosystem, offering digital payments to loans and insurance.

Learnings: Listening to user feedback can lead to profitable pivots. Scaling is more than just adding features; it’s about adding value.

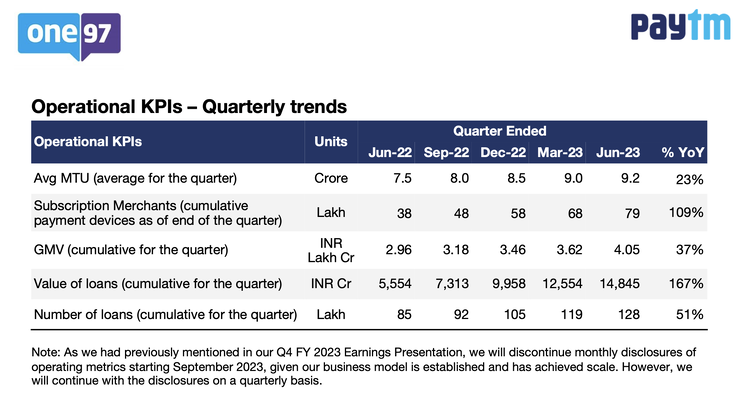

Data Points: KPIs and Metrics

330 million registered users in 2021

84 million monthly transacting users in 2022

6.1 million merchants paying subscription for payment devices in 2023

$17.9 billion merchant GMV processed in July 2023.

Learnings: KPIs should be aligned with your product goals and be actionable.

Awards and Recognitions: Product Validation | External Validation

Best apps in the Mobile/DTH Recharge & Shopping Category – Apple App Store in 2014-2015

Outstanding Performance in Highest Category of Rs 100 crores of Digital Payments – Ministry of Electronics and Information Technology, Govt of India in 2019-2020

Top FinTech Startup in India – Tracxn in 2021-2022

IoT Innovation of the Year Award in the Fintech Category for Paytm Soundbox in 2023

Learnings: Awards and recognitions are excellent external validations for your product’s market fit and value proposition.

Competitive Landscape: Product Positioning and Differentiation

Paytm’s diverse offerings and deep rural penetration set it apart from competitors like Google Pay and PhonePe.

Learnings: Understanding your USP and positioning your product effectively can give you a competitive edge.

Security Measures: User Trust and Data Privacy | Product Security & Compliance

Paytm places high emphasis on robust encryption and multiple layers of authentication.

Learnings: Earning user trust is crucial, especially in fintech. Always prioritize security.

Innovations and R&D: Continuous Improvement

Paytm is exploring AI for personalized finance.

Learnings: Continuous improvement is key. Always look for technologies that can give your product an edge.

Conclusion: The Iterative Cycle of Product Management

Paytm’s journey displays the iterative nature of product management. From identifying a market need to continuous innovation, the cycle continues.

Learnings: The job is never done. Always look for ways to iterate, improve, and serve your users better.

Your Thoughts?

What other product management principles can be applied to the cause of financial inclusion?

Feel free to share and comment.

#Product #ProductManagement #ProductStrategy